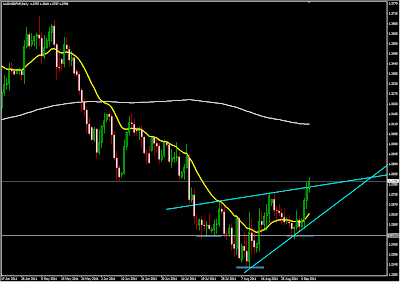

There seems to be a head and shoulder pattern forming in the daily chart of the Gbp/Cad.Next weeks MPC meeting may be crucial to this pattern totally playing out.Will wait patiently and see how it manifests itself.The market however has its own mind.

Thursday, September 29, 2011

Money management

Money management is the most important aspect in trading forex and commodities especially in times of volatility in the currency markets.It not only helps us safe guard our accounts from totally being wiped out but it allows us the comfort of having an emotional free trading environment where after placing a good trade, you can relax and let the market play itself out. We at one time or another have come to realize that we have absolutely no control over the market and sitting in front of the monitors watching every tick,every pip pass by brings in the ugly aspect of emotional trading making rush decisions that we later regret and kick ourselves.We have all been through this stage at one time or another but learning from our mistakes is key in this business.

To avoid all these,we need to plan our trades even before we make an entry in our trading platform.We must decide what is our risk reward ratio,where will we place our stop losses and what amount of money are we going to risk at any one time. Most traders recommend a 2% risk per trade since it will take you a win of 2% of your account to recover any lost trades and bring your account back to were it was.If you trade with a 3% risk per trade then you will need a 3.1% winner to recover your lost trade.This is a reasonable risk reward ratio.You should not at anyone time be exposed to more than a 6% risk,which means you might have 2 or 3 trades with a low risk of 2% per trade exposed to the market.It will take you a win of 6.4% of your account to get back to break even in case your trades went south.However if you lose 20% you will need a 25% win to get back to break even and if you lose 50% of your account, you will need a 100% to get your account back to where it was.Now that is extremely difficult if not almost impossible with the market uncertainties.

This link,will help you calculate how much you need to risk per trade on your account size in order to stay within the money management confines when trading.

money manager calculator

Below is an example of an account with Usd 5000 with a stop loss of 50 pips.You will require a 0.2 lot size or $20,000 for a 50 pips stop loss and 2% risk per trade. Take a look at it and learn how to risk small sizes on your positions.Wish you all the best and good luck trading.

To avoid all these,we need to plan our trades even before we make an entry in our trading platform.We must decide what is our risk reward ratio,where will we place our stop losses and what amount of money are we going to risk at any one time. Most traders recommend a 2% risk per trade since it will take you a win of 2% of your account to recover any lost trades and bring your account back to were it was.If you trade with a 3% risk per trade then you will need a 3.1% winner to recover your lost trade.This is a reasonable risk reward ratio.You should not at anyone time be exposed to more than a 6% risk,which means you might have 2 or 3 trades with a low risk of 2% per trade exposed to the market.It will take you a win of 6.4% of your account to get back to break even in case your trades went south.However if you lose 20% you will need a 25% win to get back to break even and if you lose 50% of your account, you will need a 100% to get your account back to where it was.Now that is extremely difficult if not almost impossible with the market uncertainties.

This link,will help you calculate how much you need to risk per trade on your account size in order to stay within the money management confines when trading.

money manager calculator

Below is an example of an account with Usd 5000 with a stop loss of 50 pips.You will require a 0.2 lot size or $20,000 for a 50 pips stop loss and 2% risk per trade. Take a look at it and learn how to risk small sizes on your positions.Wish you all the best and good luck trading.

Tuesday, September 27, 2011

Morning Technicals

Usd/Cad seems to have formed a minor pin bar on the highs with an RSI that is relatively oversold above 70. I am looking to sell this pair when it crosses the 1.0237 support line that worked well in September and October last year as support and resistance.First T.P is the 50% fib line.

Another pair I will be watching is the Nzd/Usd which seems to be on a minor correction path on the daily.RSI is oversold ,and there is some minor correction candle sticks forming which signal to me a minor bullish run.First t.p is 0.7957 which are support from the long candle stick in August and last weeks bearish bar.

Will wait and see how my plan pans out.Good luck trading to you all and do your own analysis.

Another pair I will be watching is the Nzd/Usd which seems to be on a minor correction path on the daily.RSI is oversold ,and there is some minor correction candle sticks forming which signal to me a minor bullish run.First t.p is 0.7957 which are support from the long candle stick in August and last weeks bearish bar.

Will wait and see how my plan pans out.Good luck trading to you all and do your own analysis.

Sunday, September 25, 2011

Weekly Technicals

The Market might see some minor correction this coming week as the market cools off little from last week price action that saw major rallies especially with the dollar reacting to the FOMC meeting. The Euro/Usd is bouncing off a long term trend line taken for the August 24th last year all the way to Fridays candle close with the 50% fib taken from the 7th of June 2010 to the highs on the 4th day of May 2011 . I will be watching for a bounce off the 38.2 fib taken or a little higher for entry to the downside if fundamentals remain the same with Euro crisis and risk aversion with a slow down in growth for most countries.

USD/CAD may see a correction to the downside coming of the 61.8% fib taken form the highs in may 2010 to the lows in July 26th 2011and the 1.0300 psychological level.The pair had a massive run for the last three days reacting to the FOMC meeting announcements and the move towards the dollar as a safe haven currency forming an indecision candle on Friday which may signal a move lower before we can continue with the current bullish trend that began in July before consolidation and continuation.

As for the Yen pairs i will only remain bullish on dips considering that most market experts are expecting an intervention from the B.O.J at anytime. The current prime minister has overseen three interventions and will have no problem intervening again to help the island nation from the effects of a strong Yen which is hurting the exports.A correction for most Yen pairs may be likely but always stay bullish as the Yen is largely oversold especially the GBP with RSI readings below 30.

Gold plummeted the most in two days after Thursdays announcement that saw silver loose 24%;the most it has lost since my charts can take me back. Gold is rested at the 61% fib taken from early this year to August.If economical releases continue to show a decline in growth and the continued European problems continue to affect the Euro ,we might see a correction in Gold which is expected this week.

Good luck trading to all traders and make sure you do your own analysis before you decide to trade.

USD/CAD may see a correction to the downside coming of the 61.8% fib taken form the highs in may 2010 to the lows in July 26th 2011and the 1.0300 psychological level.The pair had a massive run for the last three days reacting to the FOMC meeting announcements and the move towards the dollar as a safe haven currency forming an indecision candle on Friday which may signal a move lower before we can continue with the current bullish trend that began in July before consolidation and continuation.

As for the Yen pairs i will only remain bullish on dips considering that most market experts are expecting an intervention from the B.O.J at anytime. The current prime minister has overseen three interventions and will have no problem intervening again to help the island nation from the effects of a strong Yen which is hurting the exports.A correction for most Yen pairs may be likely but always stay bullish as the Yen is largely oversold especially the GBP with RSI readings below 30.

Gold plummeted the most in two days after Thursdays announcement that saw silver loose 24%;the most it has lost since my charts can take me back. Gold is rested at the 61% fib taken from early this year to August.If economical releases continue to show a decline in growth and the continued European problems continue to affect the Euro ,we might see a correction in Gold which is expected this week.

Good luck trading to all traders and make sure you do your own analysis before you decide to trade.

Thursday, September 22, 2011

Daily analysis

Yesterdays FOMC meeting turned out as expected by many analysts who had predicted the "operation twist" selling of short term treasuries of up to $400 billion and buying long term government bonds of the same amount in the future to try maintain a flat yield curve .The move was mainly a consumer driven approach to reduce long term rates that are used for mortgages,SME loans etc.This caused the dollar to appreciate especially against most pairs with the greater yield differentials such as the AUD,NZD and the troubled GBP. We are currently trading lower after the announcements and seems to have sold off further during the Asian session through to the European session.Market players have began acting on yesterdays news which has seen the dollar index rise extensively forcing most major pairs plunging. The Aud/Usd managed to breach a long term trend line taken from the 1st of December 2010 to 21st September 2011 price action and the 38.% fib level.

Eur/Usd has also made a lower low at 3385 today which may signal lower price action movement in the coming days.I will be looking for positions after corrections to go bearish to the 1.3000 area big round number as chasing moves after they have already gone past is a dangerous strategy that can backfire on you.The Loonie has really blown off the roof moving more than 400 pips since yesterday with the news from the FOMC meeting beginning to take effect.The CAD is closely linked to the USD by virtue of being its biggest trade partner.

There was news that Greece might actually get the requested bail out fund which prompted some of the Euro pairs to rally such as the Eur/Aud,Eur/Gbp and the Eur/Cad that have gained more than 150 pips on each.

The BOE on the other hand is trying to put in place a more or less quantitative easing programme that yesterday saw the Pound loose ground against the dollar,the Yen and the Euro with the biggest loss coming with the Yen that is under a lot of pressure due to its economical implications as it continues to appreciate against the major currencies.

The Yen which is now trading higher today against the Dollar despite some official bids to try and keep the currency a little bit weaker which saw the yen pairs rally yesterday but again finished lower. If it continues in this direction expect a lot of rhetoric from the Japanese authorities on intervention which time and time again ha proved to be fruitless against the markets looking for a haven currency. I will certainly be looking to buy into this market when we experience further appreciation of the Yen against most pairs.

Good luck trading to all and make sure you do your own analysis.

Eur/Usd has also made a lower low at 3385 today which may signal lower price action movement in the coming days.I will be looking for positions after corrections to go bearish to the 1.3000 area big round number as chasing moves after they have already gone past is a dangerous strategy that can backfire on you.The Loonie has really blown off the roof moving more than 400 pips since yesterday with the news from the FOMC meeting beginning to take effect.The CAD is closely linked to the USD by virtue of being its biggest trade partner.

There was news that Greece might actually get the requested bail out fund which prompted some of the Euro pairs to rally such as the Eur/Aud,Eur/Gbp and the Eur/Cad that have gained more than 150 pips on each.

The BOE on the other hand is trying to put in place a more or less quantitative easing programme that yesterday saw the Pound loose ground against the dollar,the Yen and the Euro with the biggest loss coming with the Yen that is under a lot of pressure due to its economical implications as it continues to appreciate against the major currencies.

The Yen which is now trading higher today against the Dollar despite some official bids to try and keep the currency a little bit weaker which saw the yen pairs rally yesterday but again finished lower. If it continues in this direction expect a lot of rhetoric from the Japanese authorities on intervention which time and time again ha proved to be fruitless against the markets looking for a haven currency. I will certainly be looking to buy into this market when we experience further appreciation of the Yen against most pairs.

Good luck trading to all and make sure you do your own analysis.

Tuesday, September 20, 2011

Moving Forward

The Euro did start the week off lower with yet another downgrade of Italy by the S&P rating agency.By now the PIIGS (Portugal,Ireland,Italy,Greece and Spain) have all been down graded and are compounding towards the Euro down fall especially against the USD. The dollar is now becoming a more attractive looking currency as a safe heaven after the Franc pegged itself to the Euro and Greece looking more and more imminent towards a default.Just seen a feature on CNN talking about an increase in suicides and depression by up to 40% this year in Greece compared to the first six months of last year with an unemployment rate of 16% with 30% being the youth.Well in Kenya with a S&P rating of B+(an upgrade mind you) unemployment rate of more than 40% and 60% or more being the youth,we should have reduced our population drastically by now. Not to mention that we are the biggest economy this side of the Sahara.I cannot begin to imagine the rescue package that is needed to begin saving our economy forget about the price controls and alcohol laws.

Tomorrows meeting may make or break the Dollar further with some analysts hoping for a QE3 of some sought but most believe that the Feds will only twist the balance sheet a little to avoid making any serious policy announcements that may exacerbate the global economic problems.

There was a minor correction back to the 38.2% fib level last week and seems to be stalling temporarily.I will be on the sidelines until i get a clear signal on the fundamentals on most of this pairs as this meeting seems to be the highlight of the month. Most pairs will really be affected by its outcome especially the commodity currencies the CAD,AUD which rely heavily on the USD when trading and the US economy.

Tomorrows meeting may make or break the Dollar further with some analysts hoping for a QE3 of some sought but most believe that the Feds will only twist the balance sheet a little to avoid making any serious policy announcements that may exacerbate the global economic problems.

There was a minor correction back to the 38.2% fib level last week and seems to be stalling temporarily.I will be on the sidelines until i get a clear signal on the fundamentals on most of this pairs as this meeting seems to be the highlight of the month. Most pairs will really be affected by its outcome especially the commodity currencies the CAD,AUD which rely heavily on the USD when trading and the US economy.

Sunday, September 18, 2011

Weekly outlook

The fundamental outlook is still bearish on most currencies especially the Euro which does not have a concrete plan on how to go about its fiscal problems.They have been moving from meeting to meeting with so many comments from every stakeholder such as Finland who were demanding collateral for the debts. However,some analysts do not think the Greece will default since the consequences for this action will have a domino effect of contagion to the other economies in Europe.The Germans and the French will do everything in their power to make sure this does not happen.The Eur/Usd is still holding at below the 38.2% fib on the daily taken from the 29th August highs to September 12th Lows off a minor correction.

The biggest event this week will be the FED meeting on Wednesday where the Chairman Ben Benanke will offer an insight regarding the Fed's policy stance and whether voting members see scope for another round of quantitative easing which many see as highly unlikely. This will definitely affect most of the currency pairs especially the Loonie that is heavily dependent on the US economy.

Gold which is a hedge against inflation for the USD will be moving higher if the dollar comes under pressure as investors look for safety for their money.The Aussie is also expected to be bearish with no expectations for interest rates increase any time soon and the poor economical data coming out of the antipodean country.As for the Yen, we should move with caution as it is expected to act soon on its strengthening currency which is at its all time highs.They might just intervene to ease strength but going by their previous interventions,the pair has often gone back to the same place it was before the intervention.So keep an eye.

Good luck trading out there and please do your own analysis before making any decisions.

The biggest event this week will be the FED meeting on Wednesday where the Chairman Ben Benanke will offer an insight regarding the Fed's policy stance and whether voting members see scope for another round of quantitative easing which many see as highly unlikely. This will definitely affect most of the currency pairs especially the Loonie that is heavily dependent on the US economy.

Gold which is a hedge against inflation for the USD will be moving higher if the dollar comes under pressure as investors look for safety for their money.The Aussie is also expected to be bearish with no expectations for interest rates increase any time soon and the poor economical data coming out of the antipodean country.As for the Yen, we should move with caution as it is expected to act soon on its strengthening currency which is at its all time highs.They might just intervene to ease strength but going by their previous interventions,the pair has often gone back to the same place it was before the intervention.So keep an eye.

Good luck trading out there and please do your own analysis before making any decisions.

Saturday, September 17, 2011

Removing Indicators

Using too many indicators in your trading system may cloud your chart,giving unclear signals that may repaint in some cases, which hampers your ability to trade consistently as a trader. To become consistently profitable you need to focus on the most important aspect of trading which is price action.

Like many novice traders,we start out by searching for the "Holy Grail" in forex that will make you $1000 a week which will in then double or even triple in the future making you a millionaire in a few months or years.Many have been lured by forex with the idea that it is a get rich quick scheme that offers financial freedom like the Ponzi or the Pyramid schemes that we had in Kenya that so many people were conned off their hard earned money by unscrupulous,inexperienced traders with poor money management skills. They had plenty of indicators on their chart that made them look like they knew what they were doing and treated forex like a gamble or a dice game.Combined with lack of emotional discipline and patience, it is no wonder many forex traders especially the novice ones cannot make it in this business.We start our charts looking like this and think that we are professionals and take every signal that comes our way.

Just like many novice traders, i too went down that path which in my opinion is a right of passage to becoming a consistently profitable trader in this business.You would study for hour in the internet searching for the right indicator that would make you that big break. You use a lot of money paying for systems that made no sense to you but you used them anyway.You would have many aha moments that amounted to nothing once they started to garner in loses and you would feel hopeless to the market forces.

However,there are many simple systems that can make you money consistently with good money management combined. You can use the simple support and resistance zones for a start to help identify areas where price may begin to move in the opposite direction or may continue with the trend.

Instead of waiting for all the indicators in your chart to align together so that you can enter a trade,which may mean missing out on many many trading opportunities, you can draw your support and resistance zones on your chart and study them and how each pair reacts to such zones.With your rules well defined for entry and exits with a risk reward ratios and good money management, you are on your way to consistent profitable trading. Notice i did not say becoming rich.This is a system that is a lot simple than having plenty of indicators on your chart that will confuse you a lot more than you were in the beginning as a novice trader. Good luck to you all.

Like many novice traders,we start out by searching for the "Holy Grail" in forex that will make you $1000 a week which will in then double or even triple in the future making you a millionaire in a few months or years.Many have been lured by forex with the idea that it is a get rich quick scheme that offers financial freedom like the Ponzi or the Pyramid schemes that we had in Kenya that so many people were conned off their hard earned money by unscrupulous,inexperienced traders with poor money management skills. They had plenty of indicators on their chart that made them look like they knew what they were doing and treated forex like a gamble or a dice game.Combined with lack of emotional discipline and patience, it is no wonder many forex traders especially the novice ones cannot make it in this business.We start our charts looking like this and think that we are professionals and take every signal that comes our way.

Just like many novice traders, i too went down that path which in my opinion is a right of passage to becoming a consistently profitable trader in this business.You would study for hour in the internet searching for the right indicator that would make you that big break. You use a lot of money paying for systems that made no sense to you but you used them anyway.You would have many aha moments that amounted to nothing once they started to garner in loses and you would feel hopeless to the market forces.

However,there are many simple systems that can make you money consistently with good money management combined. You can use the simple support and resistance zones for a start to help identify areas where price may begin to move in the opposite direction or may continue with the trend.

Instead of waiting for all the indicators in your chart to align together so that you can enter a trade,which may mean missing out on many many trading opportunities, you can draw your support and resistance zones on your chart and study them and how each pair reacts to such zones.With your rules well defined for entry and exits with a risk reward ratios and good money management, you are on your way to consistent profitable trading. Notice i did not say becoming rich.This is a system that is a lot simple than having plenty of indicators on your chart that will confuse you a lot more than you were in the beginning as a novice trader. Good luck to you all.

Tuesday, September 13, 2011

Daily Update

Gold lost ground yesterday after investors came in to cover short positions on the precious metal.This also silver and other metals loose ground as well yesterday with the commodity currencies gaining some ground on the Dollar especially the Canadian dollar.Gold which is seen as a hedge against the US dollar was an unusual move since the Dollar lost some ground with the S&P 500 gaining ground during the trading session.

The Euro is still marred by bad news but there seems to be some correction of some sought as we await Italy bond selling today which we expect the Chinese funds to flow in to help avert the situation temporarily. Even though the Greek yields are at an all time high above 100%, the French banks may be downgraded and the poorly performing ECB balance sheet, we may see some reprieve before the Euro goes lower.The US dollar is not doing that well either which may be one other reason that the EUR/USD is still holding on to its position.The currency pair is currently oversold at 30 on the 14-day relative strength indicator.

We would also expect the high yielding antipodean currencies to remain under pressure with dovish remarks coming from Newzealand which expects to keep the interest rates lower for a longer time period.The Australian dollar was also under performing which should put pressure on the RBA to move to accommodate policy stands.However, the charts speak a different language with a slight change in sentiment with this regards. There seems to be a reversal potential on the short term that we will be patient to see on how it all pans out. Good luck trading to everyone and do your own analysis before moving forward.

The Euro is still marred by bad news but there seems to be some correction of some sought as we await Italy bond selling today which we expect the Chinese funds to flow in to help avert the situation temporarily. Even though the Greek yields are at an all time high above 100%, the French banks may be downgraded and the poorly performing ECB balance sheet, we may see some reprieve before the Euro goes lower.The US dollar is not doing that well either which may be one other reason that the EUR/USD is still holding on to its position.The currency pair is currently oversold at 30 on the 14-day relative strength indicator.

We would also expect the high yielding antipodean currencies to remain under pressure with dovish remarks coming from Newzealand which expects to keep the interest rates lower for a longer time period.The Australian dollar was also under performing which should put pressure on the RBA to move to accommodate policy stands.However, the charts speak a different language with a slight change in sentiment with this regards. There seems to be a reversal potential on the short term that we will be patient to see on how it all pans out. Good luck trading to everyone and do your own analysis before moving forward.

Sunday, September 11, 2011

Weekly trades

Next week will be an interesting week with all the fundamental news going on about Greece especially for the Euro and the Dollar.But on the technical standpoint,here are some of the levels that we should be watching going forward as they may prove critical come Monday and the days to follow.

The EURUSD is right at the 61.8 Fibonacci line with a trend line cross that may signify that the bearish trend my come to halt or a break may signify further weakness.The pair has already gone past the 200 moving average and is on a very strong bearish trend after forming some lower highs and is now forming lower lows moving forward.Will be watching how it all pens out especially with the fundamentals coming out of Greece and the Euro zone at large.

Cable has also lost ground significantly and is resting at the 61.8% fib level that previously saw a pin bar form on the 12th of July and may be an area of interest. The US however seems to be strengthening and may continue its onslaught against the Pound that may be caught up in the European troubles.I will be waiting to see how the whole situation pens out come next week before i can make a decision.Happy trading to all and make sure you do your own analysis.

The EURUSD is right at the 61.8 Fibonacci line with a trend line cross that may signify that the bearish trend my come to halt or a break may signify further weakness.The pair has already gone past the 200 moving average and is on a very strong bearish trend after forming some lower highs and is now forming lower lows moving forward.Will be watching how it all pens out especially with the fundamentals coming out of Greece and the Euro zone at large.

Cable has also lost ground significantly and is resting at the 61.8% fib level that previously saw a pin bar form on the 12th of July and may be an area of interest. The US however seems to be strengthening and may continue its onslaught against the Pound that may be caught up in the European troubles.I will be waiting to see how the whole situation pens out come next week before i can make a decision.Happy trading to all and make sure you do your own analysis.

Saturday, September 10, 2011

The Amazing Correlation Between Stock Markets and Forex Rates

Think currency rates have nothing to do with stocks? Think again. They are actually quite close relatives, especially the relationship Nasdaq or Dow Jones and the US Dollars, Yen as well as Yen crosses. If you follow daily foreign exchange news, you will notice phrases such as "Yen and Dollar retreat as stock market rise" or "Yen crosses got hammered as stocks plunged." As a matter of fact, professional traders already accept this phenomenon as an indisputable fact that they don't see the need to mention it in the news.

Let me give some more examples. Four months ago before the bulk of bad financial news were released to the media, the USD and JPY were doing so badly, where the EUR cost about 1.50 USD, and it took more than 180 Yens to exchange for a British Pound (GBP). But things fell apart abruptly in matter of days, when the US government officially announced that the recession had already started a year before. Shortly afterward, several large banks collapsed around the world that quickly pulled down all stock markets. And as you could see, the USD quickly gained ground among all counterparts (except JPY), and the Yen also appreciated in the same manner. Today as I am writing this, a EUR is worth 1.30 USD (after it dropped to as low as 1.22 a few weeks ago), and a Sterling can be exchanged for only 146 yens.

But that was what happened during a four-month period. You can actually see these exchange rates fluctuate almost instantaneously with stock markets every day. The first question a novice trader may want to ask is "WHY?" Most trading experts agree that Forex market is much like stock market in terms of speculation, where price action depends much on anticipation of what will happen, instead of what already happened, or what is happening at the time being. In other words, it's the traders' mood that move the market. If traders feel good about the economy, they buy stocks as investment; whereas when the financial future seems to be threatened, they sell. And when there are more buyers than sellers, the demand is up, and so is the price.

The nature of forex market, however, is a little more sophisticated. When you deal with foreign exchange, it's always involved at least two different economies (or countries), not only one as in stock market. So the exchange rates are affected by both economies involved (in each currency pair). For example, when you trade the pair GBP/JPY, you have to watch out for what's going on in both Japan and England. Now, that's only the basics. The funny thing is, while there's nothing much going on in either of these two countries, this currency pair is actually moved by what happens in America! Reason? It's the "risk factor" that affects then Yen, which in turn affect this pair's rate.

So what is actually the "risk factor"? The risk factor of a currency depends on both geopolitical stability and interest rate. When there's nothing of warfare nature going on, this risk factor depends mostly on interest rate. JPY has been considered low risk because it has the lowest interest rate among the majors: only 0.10%, followed by the USD at 0.25%. On the other end, you may see the higher risk currencies such as NZD and AUD. To get more return, traders borrow the low-interest Yen to invest in higher-interest currencies, the activities known as carry trades. The US dollar, however, has always been considered low risk (and hence, low return) mostly because of the size of the US economy. When you buy a treasury note (underlying the stability of the USD), you'll know it's the safest investment you can get. The reason is that as large and strong as the US economy, the USD will not likely evaporate in thin air.

With the risk factor in play, traders value USD and JPY more when they perceive more risks in the market (stock market down). On the other hand, when the economy is perceived as stable, they would dump these low-risk currencies in search of higher-return counterparts, the concept known as "risk appetite" in the trading world. In conclusion, if you narrow your forex portfolio down to major pairs and Yen-crosses, then you need only look at the stock market to make your trading decisions.

Let me give some more examples. Four months ago before the bulk of bad financial news were released to the media, the USD and JPY were doing so badly, where the EUR cost about 1.50 USD, and it took more than 180 Yens to exchange for a British Pound (GBP). But things fell apart abruptly in matter of days, when the US government officially announced that the recession had already started a year before. Shortly afterward, several large banks collapsed around the world that quickly pulled down all stock markets. And as you could see, the USD quickly gained ground among all counterparts (except JPY), and the Yen also appreciated in the same manner. Today as I am writing this, a EUR is worth 1.30 USD (after it dropped to as low as 1.22 a few weeks ago), and a Sterling can be exchanged for only 146 yens.

But that was what happened during a four-month period. You can actually see these exchange rates fluctuate almost instantaneously with stock markets every day. The first question a novice trader may want to ask is "WHY?" Most trading experts agree that Forex market is much like stock market in terms of speculation, where price action depends much on anticipation of what will happen, instead of what already happened, or what is happening at the time being. In other words, it's the traders' mood that move the market. If traders feel good about the economy, they buy stocks as investment; whereas when the financial future seems to be threatened, they sell. And when there are more buyers than sellers, the demand is up, and so is the price.

The nature of forex market, however, is a little more sophisticated. When you deal with foreign exchange, it's always involved at least two different economies (or countries), not only one as in stock market. So the exchange rates are affected by both economies involved (in each currency pair). For example, when you trade the pair GBP/JPY, you have to watch out for what's going on in both Japan and England. Now, that's only the basics. The funny thing is, while there's nothing much going on in either of these two countries, this currency pair is actually moved by what happens in America! Reason? It's the "risk factor" that affects then Yen, which in turn affect this pair's rate.

So what is actually the "risk factor"? The risk factor of a currency depends on both geopolitical stability and interest rate. When there's nothing of warfare nature going on, this risk factor depends mostly on interest rate. JPY has been considered low risk because it has the lowest interest rate among the majors: only 0.10%, followed by the USD at 0.25%. On the other end, you may see the higher risk currencies such as NZD and AUD. To get more return, traders borrow the low-interest Yen to invest in higher-interest currencies, the activities known as carry trades. The US dollar, however, has always been considered low risk (and hence, low return) mostly because of the size of the US economy. When you buy a treasury note (underlying the stability of the USD), you'll know it's the safest investment you can get. The reason is that as large and strong as the US economy, the USD will not likely evaporate in thin air.

With the risk factor in play, traders value USD and JPY more when they perceive more risks in the market (stock market down). On the other hand, when the economy is perceived as stable, they would dump these low-risk currencies in search of higher-return counterparts, the concept known as "risk appetite" in the trading world. In conclusion, if you narrow your forex portfolio down to major pairs and Yen-crosses, then you need only look at the stock market to make your trading decisions.

Article by Rudy Freeman

Friday, September 9, 2011

Gold

Gold forecast remains dim after Obama speech

The CMA have also raised the margins on Gold which could also see the precious metal drop.

The CMA have also raised the margins on Gold which could also see the precious metal drop.

Wednesday, September 7, 2011

Aud/Nzd

This pair has just broken the head and shoulder pattern following the news release from Australia with there interest remaining the same at 4.75% and the not so dovish sentiments that was expected yesterday. The NZD on the other hand is not expected to move much from its current position and this may warrant the pair moving forward even further. Look out for this pair for great trading opportunities.I will be waiting for a pull back to the bottom of the inverse head and shoulder pattern for a bullish move towards 1.3000 if it breaks the 2800 round number that is currently struggling with.Good luck trading out there and watch out for the Yen for another intervention which may be soon.

Tuesday, September 6, 2011

Major volatility on SNB Peg

Today the market experienced major volatility especially with the Swiss Franc that saw the pair move 700 pips in a matter of minutes on most pairs.Most traders I believe were caught unawares considering that despite the threats by the SNB to act on the strength of the Franc it continued to gain strength even after the last week. They however decided to peg the currency.At approximately 8.00 GMT they announced that it they would set a minimum ex`change rate of 1.2000 Franc per Euro,citing the massive overvaluation of the Franc.

This announcement sent the market crazy with the Franc selling off by 700 pips in most pairs the USD being the largest gainer of them all.Most pairs moved much higher only to sell off later such as the Euro/Usd which gained more than 200 pips before plunging back down.The Eur/Jpy and the Gbp/Jpy also moved higher only to ease off and plunge to where they were before the volatility began.

The RBA also stood firm with its 4.75% rate as is growth prospects remained dovish. This however did not dampen the Aussie which moved higher against most pairs especially the NZD that has seen a bullish momentum from the beginning of the week. With no mention of a rate cut as expected and less dovish comments the Aussie seems to remain choppy with most pairs on the short term as we await to see how the Euro and US problems continue to unfold.

This announcement sent the market crazy with the Franc selling off by 700 pips in most pairs the USD being the largest gainer of them all.Most pairs moved much higher only to sell off later such as the Euro/Usd which gained more than 200 pips before plunging back down.The Eur/Jpy and the Gbp/Jpy also moved higher only to ease off and plunge to where they were before the volatility began.

The RBA also stood firm with its 4.75% rate as is growth prospects remained dovish. This however did not dampen the Aussie which moved higher against most pairs especially the NZD that has seen a bullish momentum from the beginning of the week. With no mention of a rate cut as expected and less dovish comments the Aussie seems to remain choppy with most pairs on the short term as we await to see how the Euro and US problems continue to unfold.

Monday, September 5, 2011

Weekly outlook

Today Monday 5th being a US holiday has seen the Euro continue with a bearish trend on most pairs.The Euro/Usd is currently headed for the July lows of around 4022 which could come as a strong support. The pair has been making lower lows since April all the way to August may be a sign that the Euro is slowly succumbing to pressure from the many problems it is facing. I will be watching this pair from this support level at 4022 and the 200 moving average(white line) that if breached may be a sign that the pair is actually trending downwards.

The Loonie USD/CAD has formed a bullish flag that may be indicative of a bullish continuation from the consolidation from parity in August and the 0.9753 range support line.

The Eur/Gbp is now in a consolidation and is now headed lower towards the 8650 support line that has been hit three times and is still to be broken.It has formed a consolidation between 8883 which has proven to be a major resistance line and 8650. A break below the 8752 will confirm a bearish tone for support line.The 200 moving average will pose a strong support line which could hold for a while.

Gold is also moving higher with risk aversion carrying forward from the pin bar in August that seems to be going for a new high headed for the 2000 mark soon.Silver seems to be following closely going for higher highs in the few coming weeks.The Australian dollar seems to be loosing ground with most pairs moving lower on most currencies especially the USD which is now trading much lower since Friday last week. I am watching for the 1.0373 which is heavily supported by the 200 MA and the 38.2% fib.

The Loonie USD/CAD has formed a bullish flag that may be indicative of a bullish continuation from the consolidation from parity in August and the 0.9753 range support line.

The Eur/Gbp is now in a consolidation and is now headed lower towards the 8650 support line that has been hit three times and is still to be broken.It has formed a consolidation between 8883 which has proven to be a major resistance line and 8650. A break below the 8752 will confirm a bearish tone for support line.The 200 moving average will pose a strong support line which could hold for a while.

Gold is also moving higher with risk aversion carrying forward from the pin bar in August that seems to be going for a new high headed for the 2000 mark soon.Silver seems to be following closely going for higher highs in the few coming weeks.The Australian dollar seems to be loosing ground with most pairs moving lower on most currencies especially the USD which is now trading much lower since Friday last week. I am watching for the 1.0373 which is heavily supported by the 200 MA and the 38.2% fib.

Subscribe to:

Posts (Atom)