As we approach the final two weeks of the year, liquidity is expected to run dry.We should therefore be very careful not to get caught in the opposite side of the market as any unexpected news announcements can cause a lot of volatility. The Euro has been on a downward decline from last week due to the inability of the Euro leaders to come up with a solution to their unending problems and the threat of the downgrade of the two main economies Germany and France by Fitch.S&P also threatened to downgrade the two nations after Fitch had also down graded some other European nations.This, together with other factors led the US dollar to soar against against most currencies with risk aversion kicking in which also sent Gold lower and the Yen higher.This week may be a continuation of the same with the Holiday season closing in.Euro/Usd may continue to dive as it did last week if it breaks through the 1.3000 psychological barrier from last week.However if there is some pleasant news coming from Europe this week like Germany not going to be downgraded and others,we may see some retracement of some sort from this level.

The Euro/Aud has reach a major low at 2945 which may hold well for a well as it has done historically.There is nothing much expected from the Aussie this coming week and due to the market volatility at this time any unexpected news may have an unprecedented move either way on any pair.

The dollar index is widely expected to continue with its bullish momentum from last week which saw it move higher against the Canadian dollar.A break above the trend line may signal further bullish strength considering the Euro crisis and the issues concerning crude oil world wide that really affect the oil producing country.

Gold which is a safe haven currency seems to have lost its appeal and has been declining in value for a while now.It formed an ascending triangular pattern that broke to the downside last week and may continue its decline as commodities continue to lose value across the board.

Nzd/chf seems to have reached a major psychological barrier at 7187 on the weekly time frame and is now headed lower this week with the formation of two spinning tops from the last two weeks.The SNB left the rates unchanged last week and it was highly expected that they will do something about their currency to reduce its strength.We will continue to watch it as the days go buy and try to look for opportunities to sell the pair to lower levels.

We should however be very cautious this week as most traders and institutions are closing shop this week and are only working on their books to close the year.Again, unexpected news releases can easily cause volatility that may affect your account negatively.Best of luck trading and do your analysis well before engaging the market.

Monday, December 19, 2011

Thursday, December 8, 2011

nzd/usd

This pair has been stuck on the 50% fib level taken from the highs of the 28th October and the lows of 25th November this year for the last 6 days.On the upper side is the 50 day moving average acting like resistance at the moment.The RBNZ statement yesterday has not set the pace for direction .The indecision candles are huge and have held the pair at this level for more than a week of trading.Lets wait and see how it all pans out.

NZD/JPY which more or less moves correlated with the Nzd/Usd pair is also caught up in the same area.

I will be watching these two pairs closely for any news or indicators for direction.A break may be big in either direction depending on news from either the Euro zone area or from the US.

NZD/JPY which more or less moves correlated with the Nzd/Usd pair is also caught up in the same area.

I will be watching these two pairs closely for any news or indicators for direction.A break may be big in either direction depending on news from either the Euro zone area or from the US.

Wednesday, December 7, 2011

H&S

Usd/Cad seems to have formed a head and shoulder pattern on the daily chart with the right shoulder seemingly shorter that the left one.Target for this would be in the 9650 if it does play out.

Tuesday, December 6, 2011

Intra Day action

Most of the pairs as we had predicted have eventually taken direction such as the Euro/Usd which is now headed lower but the plenty meetings this week will eventually determine the direction of the Euro.We are waiting to see if they will finally come up with a serious plan to save the 17 nation currency once and for all with proper steps in place on how to do it.

However, I am watching gbp/chf which has formed an ascending wedge and is breaking out on the 4hr.Waiting for a pull back and break to get in considering the swiss Francs weakness this last few days.

Cable is also in an ascending wedge formation which has not yet broken lower. It is currently supported at the 50 day MA and seems unable to break the LTL of the triangular pattern.We will also watch this pair as an opportunity to gain some pips may become available.A nice candle stick pin is forming at the moment but we have to wait and see how it finishes.

Lets watch these two pairs for an opportunity to to get some pips.

However, I am watching gbp/chf which has formed an ascending wedge and is breaking out on the 4hr.Waiting for a pull back and break to get in considering the swiss Francs weakness this last few days.

Cable is also in an ascending wedge formation which has not yet broken lower. It is currently supported at the 50 day MA and seems unable to break the LTL of the triangular pattern.We will also watch this pair as an opportunity to gain some pips may become available.A nice candle stick pin is forming at the moment but we have to wait and see how it finishes.

Lets watch these two pairs for an opportunity to to get some pips.

Monday, December 5, 2011

December 5th 2011

It is the day the Doctors strike officially begins but for us its a different ball game.I believe it is at this time of the year that we will start to feel liquidity begin to reduce as most fund managers close for the festive season.However,I have some price action trades I will be focused on this week.The Euro/Usd which is still grappling under plenty a problem formed a major bearish candle last week and in my opinion seems to be headed even further lower unless some unexpected short term news comes out again.

Usd/Cad has a major bullish candle off the daily charts from a good support line which may hold for a while.This is a bullish looking signal for the next level 1.0250 that will act as a major resistance to the pair.

The Yen pairs have formed a bearish pin on the daily time frames which may be a catalysts for bearish price action.Gbp/jpy has moved lower from the 38% fib level from the most recent highs and lows and stuck in between the 20 and 50 day moving average.The Euro/Jpy has moved off the 50 day moving average and the seems to be headed lower if it moves past the 20 day moving average.

I will continue to update this week with more chart.Good luck to all and make sure you do your own analysis.

Usd/Cad has a major bullish candle off the daily charts from a good support line which may hold for a while.This is a bullish looking signal for the next level 1.0250 that will act as a major resistance to the pair.

The Yen pairs have formed a bearish pin on the daily time frames which may be a catalysts for bearish price action.Gbp/jpy has moved lower from the 38% fib level from the most recent highs and lows and stuck in between the 20 and 50 day moving average.The Euro/Jpy has moved off the 50 day moving average and the seems to be headed lower if it moves past the 20 day moving average.

I will continue to update this week with more chart.Good luck to all and make sure you do your own analysis.

Sunday, November 27, 2011

Coming week 28th November 2011

The Euro zone crisis continues with the down grade of two nations Belgium and Portugal by Fitch and S&P which has further exacerbated the decline of the 17 nations union.The German 10 yr bond auction certainly did little to help the situation and the Euro might face further decline this coming week. The pair is now at a weekly support line with a minor trend line and might find some temporary relief from the four week declines.

Eur/Cad and Eur/Aud are both caught up in congestion areas and continue to make lower lows.Bearish momentum with the Euro may continue to be felt this coming week with the commodity currencies also feeling the effect of the global growth slow down.

On the Other hand the New Zealand dollar went lower affected by the events in Europe further completing a head and shoulders pattern we had formed a few weeks ago.It has broken a rising trend line and is headed lower if the global growth outlook continues to be negative.

The Gbp/Nzd and the Eur/Nzd which are highly correlated pairs have reached a resistance zone that could not be penetrated since last week.We have been watching the Gbp/Nzd with a lot of zeal since last week but has been unable to move higher forming a bearish shooting star on the weekly time frame. My outlook is still bearish for both pairs considering the many Euro zone problems that continue to weigh heavily on the Euro.The Eur/Nzd has formed a doji from the 8110 level resistance and is largely overbought.

Good luck trading out there and make sure you do your own analysis before engaging the markets.

Eur/Cad and Eur/Aud are both caught up in congestion areas and continue to make lower lows.Bearish momentum with the Euro may continue to be felt this coming week with the commodity currencies also feeling the effect of the global growth slow down.

On the Other hand the New Zealand dollar went lower affected by the events in Europe further completing a head and shoulders pattern we had formed a few weeks ago.It has broken a rising trend line and is headed lower if the global growth outlook continues to be negative.

The Gbp/Nzd and the Eur/Nzd which are highly correlated pairs have reached a resistance zone that could not be penetrated since last week.We have been watching the Gbp/Nzd with a lot of zeal since last week but has been unable to move higher forming a bearish shooting star on the weekly time frame. My outlook is still bearish for both pairs considering the many Euro zone problems that continue to weigh heavily on the Euro.The Eur/Nzd has formed a doji from the 8110 level resistance and is largely overbought.

Good luck trading out there and make sure you do your own analysis before engaging the markets.

Monday, November 21, 2011

21st November 2011

The Euro/Usd last week saw a lot of bearish momentum with the strengthening of the US dollar all the way to the 1.3500 mark that I believe may be a tough support to break.With all rhetoric and sentiments about the ECB now being able to lend money to the IMF to help out ailing economies giving minor reprieve to the Euro and bonds now lower than the 7%,the Euro is still under a lot of pressure that make it difficult to trade.

For Eur/Usd on the 3500 mark I am expecting some minor retrace up before we can continue with the down fall to much lower levels.Sentiment is still bearish for this pair with some strength coming from the US early this morning on a deadlock over budget cuts as the 23rd November deadline approaches. A break below the 3500 mark may signal further weakness to 3250 and later 3000 mark.

The New Zealand Dollar against the Yen and the Dollar has reached a major trend line from June 2010 all the way to last week's price action on the daily charts and may be respected for a while should the currency manage to gather some strength this coming week.There is however a lot of flight to safety to less risky assets and the high yielding currency may feel the effect especially with its deficits.

Nzd/Jpy also has a major trend line from February 2009 to last weeks price action.A break below this trend line may signal further weakness and bearish break towards the 50's.

The British Pound seems to be heading lower this week as the British economy continues to falter.However,the Pound seems to be the recipient of capital flows from the Euro which may indicate that it is somehow becoming some safe haven currency.This may continue to bolster the currency against some currencies such as the CAD and the Euro. The Gbp/Jpy continues to trade lower this week with a touch of the 61.8% fib level on the weekly chart as it seems Japanese interventions bears no fruit.We will patiently on the daily charts to see of it breaks this level lower or it will hold.

Gbp/Nzd has reached a major resistance line at 2.0900 which has held off quite well in may this year.I am of the opinion that it will retrace a bit to previous weekly highs 2.05815 before we can continue forward.

WTI crude oil has formed a bearish candle off the 61.8% fib line and is mostly oversold.It however opened much higher from Fridays close but i am expecting some bearish momentum this week.Lets continue to watch on the sidelines for further confirmations.

Those are my sentiments for this week.Make sure you do your own analysis before engaging the market.Best of luck to all.

For Eur/Usd on the 3500 mark I am expecting some minor retrace up before we can continue with the down fall to much lower levels.Sentiment is still bearish for this pair with some strength coming from the US early this morning on a deadlock over budget cuts as the 23rd November deadline approaches. A break below the 3500 mark may signal further weakness to 3250 and later 3000 mark.

The New Zealand Dollar against the Yen and the Dollar has reached a major trend line from June 2010 all the way to last week's price action on the daily charts and may be respected for a while should the currency manage to gather some strength this coming week.There is however a lot of flight to safety to less risky assets and the high yielding currency may feel the effect especially with its deficits.

Nzd/Jpy also has a major trend line from February 2009 to last weeks price action.A break below this trend line may signal further weakness and bearish break towards the 50's.

The British Pound seems to be heading lower this week as the British economy continues to falter.However,the Pound seems to be the recipient of capital flows from the Euro which may indicate that it is somehow becoming some safe haven currency.This may continue to bolster the currency against some currencies such as the CAD and the Euro. The Gbp/Jpy continues to trade lower this week with a touch of the 61.8% fib level on the weekly chart as it seems Japanese interventions bears no fruit.We will patiently on the daily charts to see of it breaks this level lower or it will hold.

Gbp/Nzd has reached a major resistance line at 2.0900 which has held off quite well in may this year.I am of the opinion that it will retrace a bit to previous weekly highs 2.05815 before we can continue forward.

WTI crude oil has formed a bearish candle off the 61.8% fib line and is mostly oversold.It however opened much higher from Fridays close but i am expecting some bearish momentum this week.Lets continue to watch on the sidelines for further confirmations.

Those are my sentiments for this week.Make sure you do your own analysis before engaging the market.Best of luck to all.

Wednesday, November 16, 2011

Check your broker

I have been browsing through the charts and came across something that really puzzled me.Look at a chart on the NZD/USD.Now,on one broker it went all the way to 7320's while on most broker feeds it is still around 7600.You have to check your broker.This is a clear case of a broker going stop hunting.The wick on the tail is too long for any broker feed.

Other brokers are still higher.

This same broker has had cases in court for some of these reasons and had to compensate some clients I think in the beginning of the year.

It is for this reason that you should know your broker well and compare feeds between them.In most cases, you have brokers going for your stops only to turn and move to where your take profit was. I find this very prohibitive in terms of business relations with the clients.Very sad indeed.

Other brokers are still higher.

This same broker has had cases in court for some of these reasons and had to compensate some clients I think in the beginning of the year.

It is for this reason that you should know your broker well and compare feeds between them.In most cases, you have brokers going for your stops only to turn and move to where your take profit was. I find this very prohibitive in terms of business relations with the clients.Very sad indeed.

Tuesday, November 15, 2011

Quick note

Aud/Usd has formed a head and shoulder pattern that may be completed any time soon.If it breaks the neckline of the pattern I am guessing the next level will be the 9500.Both shoulders were unable to get passed the 200 MA and price is currently about to complete the right shoulder.I will be waiting for a break and pullback of the pair before I can enter short.

Good luck trading to all.

Good luck trading to all.

Friday, November 11, 2011

11/11/11

Today being 11/11/11 I have put up some trades based purely on technical analysis.The markets have been very erratic of late and fundamentals are only making it more difficult to trade.I have a buy signal on an indecision candle off the 50% fib level on the AUD/USD pair and a buy signal off the NZD/USD pair as well off the 50% fib level.This in my opinion is will be a minor retrace level from the weeks bearish momentum that begun on Wednesday.

Gbp/Aud is also at the 50% fib level and has formed a bearish hammer after a big candle on Wednesday. The pair is also overbought and my sentiments are for the downside at least a minor retracement before any continuations.

Lastly the Eur/Nzd is at a major resistance level of 1.7515 that has price falling hard every time it has been able to get to it.After yesterdays strong bullish candle, I am seeing the pair move back to the 7278 level that is my first support level if it gets past the 20 day moving average.

These are my thought and sentiments on today's technical analysis.Good luck trading to everyone and please do your own analysis before you enter the markets.

Gbp/Aud is also at the 50% fib level and has formed a bearish hammer after a big candle on Wednesday. The pair is also overbought and my sentiments are for the downside at least a minor retracement before any continuations.

Lastly the Eur/Nzd is at a major resistance level of 1.7515 that has price falling hard every time it has been able to get to it.After yesterdays strong bullish candle, I am seeing the pair move back to the 7278 level that is my first support level if it gets past the 20 day moving average.

These are my thought and sentiments on today's technical analysis.Good luck trading to everyone and please do your own analysis before you enter the markets.

Wednesday, November 9, 2011

Market update.

There is very little movement in terms of Price action going on with the markets really consolidating and barely moving in any direction right now.Most USD pairs are in congestion zones and have made very little progress on the daily charts so far.The Eur/Usd is in a rising wedge in the 4hr chart but caught up in a congestion area in the daily chart.I am hoping for a break of this zones so that price action momentum can resume.However,this can only happen if fundamentals start to kick in with the Italian prime minister saying that he will quit once the austerity laws are in place.Italy is one of the biggest economical nations in the Euro and any news from this region will cause a lot of volatility.We will be watching closely for more fundamental news from Europe for Price action.

In the 4hr it looks like it is imminent for a break after a consolidation for days. It did actually break to the down side with news that Italian bonds went passed the 7% mark.

Possible head and shoulder like pattern formation on the Nzd/Usd.Lets wait and see how it all pans out for further technical implications.

Cable is at a resistance on the 200 MA and may be bearish after failing to break past this resistance.Today may be bullish for the pound but the pair is still caught up in a congestion area which we will wait patiently for a convincing break to continue with the trend.This may come in tomorrow with plenty economical news from the Pound with the MPC rate statement,official bank rate and the asset purchase facility releases.It also broke to the downside now trading lower with news from Italy.

Yen pairs on the other hand seem to be retracing all the gains after the intervention by the finance minister of Japan.Most of the pairs have already lost most gains and the USD/JPY is no exception showing further losses since yesterday with continuation today headed for the 77.00 level.This in my opinion may prompt further intervention with losses against the greenback.I will stay bullish on the Yen when it moves to lower levels as the BOJ may act again to weaken its currency.

Good luck trading and do your own analysis.

In the 4hr it looks like it is imminent for a break after a consolidation for days. It did actually break to the down side with news that Italian bonds went passed the 7% mark.

Possible head and shoulder like pattern formation on the Nzd/Usd.Lets wait and see how it all pans out for further technical implications.

Cable is at a resistance on the 200 MA and may be bearish after failing to break past this resistance.Today may be bullish for the pound but the pair is still caught up in a congestion area which we will wait patiently for a convincing break to continue with the trend.This may come in tomorrow with plenty economical news from the Pound with the MPC rate statement,official bank rate and the asset purchase facility releases.It also broke to the downside now trading lower with news from Italy.

Yen pairs on the other hand seem to be retracing all the gains after the intervention by the finance minister of Japan.Most of the pairs have already lost most gains and the USD/JPY is no exception showing further losses since yesterday with continuation today headed for the 77.00 level.This in my opinion may prompt further intervention with losses against the greenback.I will stay bullish on the Yen when it moves to lower levels as the BOJ may act again to weaken its currency.

Good luck trading and do your own analysis.

Sunday, November 6, 2011

Monday 7th November

All through last week the Euro drew most attention with Greece's Prime Minister pushing through a vote on EU's austerity plan,which was crucial on the countries membership in the EU. The market's fear for such news meant risky assets fleeing from most currencies and mainly to the greenback. The rate cut during the week and the impending problems in Italy the third largest economy in the Euro zone will weigh heavily on the currency on the coming days. The Euro which lost most of its gains in the previous week was one of the biggest losers and seems to be poised for the same bearish momentum with a close below most moving averages that have compressed together on the weekly chart which may signal further downward momentum should it cross the 3700 psychological number.

The Yen pairs on the other hand seem to have gained some strength after the intervention that saw the Yen move much higher against the greenback early Monday morning. This seems to be short lived against most of the currencies as it gained most of its strength through out the week last week.This week I expect the Yen to continue to gather more strength with a bearish formation candle with most pairs especially the Newzealand dollar and the Euro despite its escalating fears of Italy and Portugal.

The Eur/Nzd pair is forming a weekly triangular pattern that looks to break on the upper trendline that is supported by the 50 day moving average.A break above the 7468 resistance line and the 50 MA may signal further bullish momentum should some confidence come back to Europe in terms of the temporary stop gap measures.

Finally Gold broke out of the bearish flag pattern on the daily chart without much momentum and seems to be headed further up with all the problems being experienced in most countries especially in Europe that seems to be spreading out even to US.With China a major business partner not getting involved in bailing out Europe it may signal further strength for the precious stone to continue bullish in the next few days.

This are my opinions on the this coming week.Make sure you do your own analysis and good luck trading to all.

The Yen pairs on the other hand seem to have gained some strength after the intervention that saw the Yen move much higher against the greenback early Monday morning. This seems to be short lived against most of the currencies as it gained most of its strength through out the week last week.This week I expect the Yen to continue to gather more strength with a bearish formation candle with most pairs especially the Newzealand dollar and the Euro despite its escalating fears of Italy and Portugal.

The Eur/Nzd pair is forming a weekly triangular pattern that looks to break on the upper trendline that is supported by the 50 day moving average.A break above the 7468 resistance line and the 50 MA may signal further bullish momentum should some confidence come back to Europe in terms of the temporary stop gap measures.

Finally Gold broke out of the bearish flag pattern on the daily chart without much momentum and seems to be headed further up with all the problems being experienced in most countries especially in Europe that seems to be spreading out even to US.With China a major business partner not getting involved in bailing out Europe it may signal further strength for the precious stone to continue bullish in the next few days.

This are my opinions on the this coming week.Make sure you do your own analysis and good luck trading to all.

Thursday, November 3, 2011

Todays Opportunities

Head and shoulders pattern formation on the Aud/Jpy on the 4hr chart that may be worth looking at.A break below the neck line may signal a bearish momentum towards 75.00.

Gold on the other hand is back is looking bearish after a bullish break from the 1683 area which has proved to be a strong support and resistance line all the way to the trend line.It has moved back into the bullish trend channel formed from the 27th of September.Will be watching today's price action to see how it moves to make a decision on how to trade the precious metal.

Gold on the other hand is back is looking bearish after a bullish break from the 1683 area which has proved to be a strong support and resistance line all the way to the trend line.It has moved back into the bullish trend channel formed from the 27th of September.Will be watching today's price action to see how it moves to make a decision on how to trade the precious metal.

Thursday, October 27, 2011

The pound

The pound is tightly consolidated with some pairs and seems to be headed for a break out with risk appetite or the lack of it.The Gbp/Aud is tightly consolidated in the 4hr chart since 13th October with an upper trend line and the 5247 support line.

Gbp/Nzd has a bullish looking wedge formation on the 4hr that is currently bearish on the 50 day moving average.

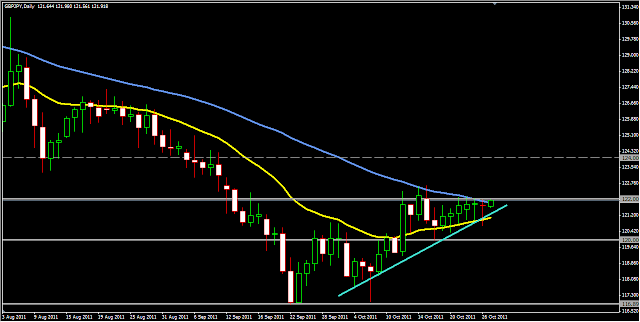

Gbp/Jpy is currently caught up by the 122 resistance line and a trend line from early October this year.This, in my opinion is a looming bearish break considering the support at 122 on the daily chart.

The Cad/Jpy and Aud/Jpy have also consolidated together with the daily moving averages which means that any decision from the BOJ can spark a mad breakout from this zones.Be sure to be on the right side of the trade.

Good luck trading and make sure you do your won analysis.

Gbp/Nzd has a bullish looking wedge formation on the 4hr that is currently bearish on the 50 day moving average.

Gbp/Jpy is currently caught up by the 122 resistance line and a trend line from early October this year.This, in my opinion is a looming bearish break considering the support at 122 on the daily chart.

The Cad/Jpy and Aud/Jpy have also consolidated together with the daily moving averages which means that any decision from the BOJ can spark a mad breakout from this zones.Be sure to be on the right side of the trade.

Good luck trading and make sure you do your won analysis.

Wednesday, October 26, 2011

EU Economic summit

Euro zone leaders have still not reached an agreement on the much anticipated deal to try and reverse the spiraling debt crisis despite the summit today that is supposed to offer a definitive agreement.Talks to try and get emerging markets to lend a hand by buying European bonds have hit a snag. The market is already expecting a less than dovish outcome as a meeting of European finance ministers has been canceled which means that the anything from the leaders meeting will lack detail.There has also been a lot of division on how to tackle the Euro crisis issue between European leaders which further indicates that today's meeting may offer only a short term or weak solutions.This further exacerbates the problem.

However,despite the gloom being painted a show of commitment from the EU leaders may ignite a different spark which might rally the Euro higher.News of speculation that more stimulus might be forth coming for the US has also seen the market rally in favor of the Dollar. I will also be watching the Yen currency pairs are fears of a stronger Yen may prompt some action from the BOJ.

Monday, October 24, 2011

Monday morning

Aud/Usd has passed a daily trend line,made a minor pull back and is now bullish at the moment.However the 61.8 fib which is right above the 1.0400 round number will be a major barrier for this pair.A break above this level will signal bullish momentum to the 1.0500 round number and then to the 78.6% fib level.

Same goes for Aud/Jpy which is has gone past the daily trend line and is bullish at the moment.A break above the 50% fib which has held as support over the days will signal a more bullish momentum to the 61.8% fib.

The Eur/Nzd seems to be breaking lower from the descending triangle formation and might be headed for the 7100 level.There is however the 50 day moving average to contend with before it can further continue lower if this is a true break of the congestion pattern on the daily chart.

Good luck trading to all,make sure you do your own analysis.

Same goes for Aud/Jpy which is has gone past the daily trend line and is bullish at the moment.A break above the 50% fib which has held as support over the days will signal a more bullish momentum to the 61.8% fib.

The Eur/Nzd seems to be breaking lower from the descending triangle formation and might be headed for the 7100 level.There is however the 50 day moving average to contend with before it can further continue lower if this is a true break of the congestion pattern on the daily chart.

Good luck trading to all,make sure you do your own analysis.

Subscribe to:

Posts (Atom)