The pound is tightly consolidated with some pairs and seems to be headed for a break out with risk appetite or the lack of it.The Gbp/Aud is tightly consolidated in the 4hr chart since 13th October with an upper trend line and the 5247 support line.

Gbp/Nzd has a bullish looking wedge formation on the 4hr that is currently bearish on the 50 day moving average.

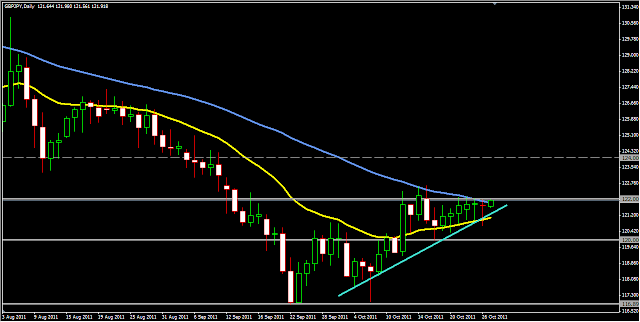

Gbp/Jpy is currently caught up by the 122 resistance line and a trend line from early October this year.This, in my opinion is a looming bearish break considering the support at 122 on the daily chart.

The Cad/Jpy and Aud/Jpy have also consolidated together with the daily moving averages which means that any decision from the BOJ can spark a mad breakout from this zones.Be sure to be on the right side of the trade.

Good luck trading and make sure you do your won analysis.

Thursday, October 27, 2011

Wednesday, October 26, 2011

EU Economic summit

Euro zone leaders have still not reached an agreement on the much anticipated deal to try and reverse the spiraling debt crisis despite the summit today that is supposed to offer a definitive agreement.Talks to try and get emerging markets to lend a hand by buying European bonds have hit a snag. The market is already expecting a less than dovish outcome as a meeting of European finance ministers has been canceled which means that the anything from the leaders meeting will lack detail.There has also been a lot of division on how to tackle the Euro crisis issue between European leaders which further indicates that today's meeting may offer only a short term or weak solutions.This further exacerbates the problem.

However,despite the gloom being painted a show of commitment from the EU leaders may ignite a different spark which might rally the Euro higher.News of speculation that more stimulus might be forth coming for the US has also seen the market rally in favor of the Dollar. I will also be watching the Yen currency pairs are fears of a stronger Yen may prompt some action from the BOJ.

Monday, October 24, 2011

Monday morning

Aud/Usd has passed a daily trend line,made a minor pull back and is now bullish at the moment.However the 61.8 fib which is right above the 1.0400 round number will be a major barrier for this pair.A break above this level will signal bullish momentum to the 1.0500 round number and then to the 78.6% fib level.

Same goes for Aud/Jpy which is has gone past the daily trend line and is bullish at the moment.A break above the 50% fib which has held as support over the days will signal a more bullish momentum to the 61.8% fib.

The Eur/Nzd seems to be breaking lower from the descending triangle formation and might be headed for the 7100 level.There is however the 50 day moving average to contend with before it can further continue lower if this is a true break of the congestion pattern on the daily chart.

Good luck trading to all,make sure you do your own analysis.

Same goes for Aud/Jpy which is has gone past the daily trend line and is bullish at the moment.A break above the 50% fib which has held as support over the days will signal a more bullish momentum to the 61.8% fib.

The Eur/Nzd seems to be breaking lower from the descending triangle formation and might be headed for the 7100 level.There is however the 50 day moving average to contend with before it can further continue lower if this is a true break of the congestion pattern on the daily chart.

Good luck trading to all,make sure you do your own analysis.

Friday, October 21, 2011

Forex Managed accounts 101

A forex managed account is great investment vehicle anyone can have in their portfolio with a professional forex and commodity trader. Forex can be traded for 24 hours a day 5 days a week and you can either sell or buy in this market.Liquidity is extremely high up to $4 trillion plus and it is almost impossible to manipulate this market.

However,there are a lot of scammers trying to take advantage of investors who know nothing about the specifics of the market. They write up wonderful reviews, open up incredible forums and create outstanding programmes that can catch the eye of any potential investor.They will entice you with returns of 100% in 3 months or make 50% returns every week which feeds on your greed and your ambitions to becoming richer faster than our Member of Parliament. But for any wise investor, very few investments can make anyone rich overnight.Apart from robbing a bank or a jewelry store or something of that nature,the only way to becoming successful is by working hard and smart.That is the secret and the "Holy Grail" to success.And Forex trading is no exception.

To avoid investing with the wrong crowd, you should first and foremost try to learn a little bit about your investment option. Let you account manager explain to you what you are getting into and what the benefits and draw downs are to this business.Let him/her show you their past performance to make you aware of the potential the business has.

Secondly, Never ever send money to someone's account or some company's account at any one time.This is the biggest mistake people make; that so and so is trading for me.You have no control over what the person or company is doing with your money and you have no one to blame once your money has been lost. You should instead work with your manager to open an account with the preferred broker, preferable an ECN regulated broker where you will have access to your money at all times.Only you can Withdraw or Deposit to your account and not your manager.The manager will only be allowed to trade on your behalf after you have signed a Limited Power of Attorney form that specifically authorizes him to do so.You have the ability to stop trading activities of your account at any time.

Finally, no one can guarantee you a certain profit percentage.The market is too volatile and risky that regardless of how many moon years you have been trading, you can still make losses.The bottom line in this business is to make your wins so much bigger than your losses to stay profitable.There is no investment in the world that does not make losses at one time or another and forex trading is no exception.Do not be fooled by amazing reviews on the net of how someone made a fortune and no longer goes to work or now lives in Lavington or Karen.That is a joke right there,Ignore it.

Forex trading is an investment like any other that has its ups and downs but with a good professional manager can be a consistence source of good profits to add to your portfolio.

Congestion areas

Most pairs especially the Loonie are caught up in congestion zones forming flag patterns and ascending triangles.The Gbp/Cad has formed a pennant which is a continuation pattern on the daily chart.A break above the consolidation will be headed for the previous highs of 6381 which is a previous resistance.

Eur/Cad has also formed a pennant with a trend line from the 23rd August candle.The pattern is supported by the 50 and 20 MA's that are moving together with the trend line on the lower side.A break above signals a bullish move towards 4300 which is a previous resistance back in August.I will wait for a break and a pull back to enter.

Eur/Nzd has a similar formation to Eur/Cad which will target the 7600 on the daily chart.

Aud/Cad is caught up in a congestion zone that has been well supported over the days since mid July 2011 to date forming lower highs each time it gets to the top.I will be looking for a short sell today to the support line at 1.0232 and then further lower once the line is tested and broken.

Good luck trading,these are my thoughts of the day.Today is Friday so be very careful especially with the news of the demise of the King of Kings Mommar Gaddafi.It may affect the movement of commodity pairs that are heavily reliant on Oil as an export and the WTI oil prices.

Eur/Cad has also formed a pennant with a trend line from the 23rd August candle.The pattern is supported by the 50 and 20 MA's that are moving together with the trend line on the lower side.A break above signals a bullish move towards 4300 which is a previous resistance back in August.I will wait for a break and a pull back to enter.

Eur/Nzd has a similar formation to Eur/Cad which will target the 7600 on the daily chart.

Aud/Cad is caught up in a congestion zone that has been well supported over the days since mid July 2011 to date forming lower highs each time it gets to the top.I will be looking for a short sell today to the support line at 1.0232 and then further lower once the line is tested and broken.

Good luck trading,these are my thoughts of the day.Today is Friday so be very careful especially with the news of the demise of the King of Kings Mommar Gaddafi.It may affect the movement of commodity pairs that are heavily reliant on Oil as an export and the WTI oil prices.

Thursday, October 20, 2011

Cable

Cable is now at the 38% Fibonacci level taken from 18th of August highs and 5th October lows and the 50 day moving average.There is a trend line from the 19th July candle stick that is clearly a barrier at the 38% fib level. A break above the fib line might signal further strength to 5900 then the big psychological level of 6000.Will see how it pans out come tomorrow.

Wednesday, October 19, 2011

Todays possible trades

The Eur/Nzd pair seems to be consolidating forming a consolidation flag on the daily that may break out in a bullish direction. The Euro however seems to have opened higher especially in the Eur/Usd negating the Monday bearish bar that threatened a change in momentum.I will be watching this pair for a break, a pull back and continuation to enter on the direction of the trend.

With the early morning strength of the Euro I have entered a long on the Eur/Jpy which has formed an indecision candle or spinning top on the the daily off the 21 moving average and the 105 psychological level. My target is the 107 level or the 50 day moving average that may be a resistance.

The Aud/Jpy might also see some bullishness crossing over a long term trend line with the formation of a bullish harami above the 50 day moving average.T.P for that one is 80 which is a big round number.

The Antipodes are also showing some strength against the USD which seems to be weaker this morning across the board. The Monday bar that was bearish has been negated by most pairs and they all seem to be moving upwards supported by the 21 day moving average.Target for that is 8050 in the Nzd/Usd.

I am also short on Usd/Cad which is showing some bearish momentum since yesterday with the formation of the big bearish candle from 1.0255.My target for that one is parity which is highly likely considering the fundamental aspects of the pair.

Wish the best trading out there and do your own analysis before engaging the market.

With the early morning strength of the Euro I have entered a long on the Eur/Jpy which has formed an indecision candle or spinning top on the the daily off the 21 moving average and the 105 psychological level. My target is the 107 level or the 50 day moving average that may be a resistance.

The Aud/Jpy might also see some bullishness crossing over a long term trend line with the formation of a bullish harami above the 50 day moving average.T.P for that one is 80 which is a big round number.

The Antipodes are also showing some strength against the USD which seems to be weaker this morning across the board. The Monday bar that was bearish has been negated by most pairs and they all seem to be moving upwards supported by the 21 day moving average.Target for that is 8050 in the Nzd/Usd.

I am also short on Usd/Cad which is showing some bearish momentum since yesterday with the formation of the big bearish candle from 1.0255.My target for that one is parity which is highly likely considering the fundamental aspects of the pair.

Wish the best trading out there and do your own analysis before engaging the market.

Tuesday, October 18, 2011

short term trades

The Pound has found some strength this week trading stronger on most pairs.I am long the Gbp/Aud that started out this Monday with a minor divergence on the RSI and big bullish candle from yesterday.My target may be the 5600 mark and after that the 5750.

Aud/Usd may be headed lower at least for the next few days to parity after reaching the 50% and the 61.8% fib lines territory.The Monday candle which was a big bearish signal further strengthens my conviction towards parity and the recent fundamental implications of the pair.

Good luck trading out there,these are my own analysis make sure you do your own.

Aud/Usd may be headed lower at least for the next few days to parity after reaching the 50% and the 61.8% fib lines territory.The Monday candle which was a big bearish signal further strengthens my conviction towards parity and the recent fundamental implications of the pair.

Good luck trading out there,these are my own analysis make sure you do your own.

Friday, October 14, 2011

Possible short term trades

I have a couple of trades that may play out on the short term considering the current financial situation the market is in at the moment. Usd/Cad is a descending channel that may continue to hold on the 4hr considering the effects of the Dollar to the Loonie.

The Aussie is at a big round number of 1.0200 holding it as resistance in a rising channel. A break above this level would signal further upward strength as there is a lot of consolidation at this point in the 4 hr time frame.There is further support by the 200 day moving average which hasn't been broken for a while.

The Nzd/Usd has reached the 38% fib and has been unable to move past the trend line that is dated from the 31st of August this year.A break above this level will signal further upward pressure but it is highly unlikely to do so.

The Eur/Gbp has tested the 4hr trend line and is headed upwards should it manage to get passed the 0.8741 resistance line.This trend line which is dated back from the 31st of August has formed a triangle formation which seems to have broken and is finding some bullish momentum.

Eur/Cad is at a strong resistance line off the 78.6% fib level on the 4 hr time frame.This could be a good short term trade to the 61.8% fib level which would consolidate the bullish flag pattern being formed in the shorter time frame.

Aud/Nzd is at a strong resistance level of 2800 which is also a big psychological number.The pair has been held at this point as support and resistance before and may hold again as resistance.Lets see how it pans out before we can make any decisions.A break may signal more upward pressure towards the 3000 big round number

One to watch is the Nzd/Chf which has been unable to get pat the 7137 resistance line and in the process forming a bullish triangle pattern on the 4 hr. I am expecting a bearish break on this one but will wait for a retest of the trend line before any entries on the downside.

This are my thoughts on today's price action please do your own analysis before entering on any positions.Good luck trading to all.

The Aussie is at a big round number of 1.0200 holding it as resistance in a rising channel. A break above this level would signal further upward strength as there is a lot of consolidation at this point in the 4 hr time frame.There is further support by the 200 day moving average which hasn't been broken for a while.

The Nzd/Usd has reached the 38% fib and has been unable to move past the trend line that is dated from the 31st of August this year.A break above this level will signal further upward pressure but it is highly unlikely to do so.

The Eur/Gbp has tested the 4hr trend line and is headed upwards should it manage to get passed the 0.8741 resistance line.This trend line which is dated back from the 31st of August has formed a triangle formation which seems to have broken and is finding some bullish momentum.

Eur/Cad is at a strong resistance line off the 78.6% fib level on the 4 hr time frame.This could be a good short term trade to the 61.8% fib level which would consolidate the bullish flag pattern being formed in the shorter time frame.

Aud/Nzd is at a strong resistance level of 2800 which is also a big psychological number.The pair has been held at this point as support and resistance before and may hold again as resistance.Lets see how it pans out before we can make any decisions.A break may signal more upward pressure towards the 3000 big round number

One to watch is the Nzd/Chf which has been unable to get pat the 7137 resistance line and in the process forming a bullish triangle pattern on the 4 hr. I am expecting a bearish break on this one but will wait for a retest of the trend line before any entries on the downside.

This are my thoughts on today's price action please do your own analysis before entering on any positions.Good luck trading to all.

Sunday, October 9, 2011

Trade outlooks 10th October 2011

The Euro is once again,as always under pressure with the Greece repayment on Friday and the downgrades by Fitch of Spain and Italy last week that saw the currency drop lower against most pairs.The market however does not expect the Greece to default even though the meeting on the 13th of October of finance ministers that was expected to discuss the next tranche of aid to the troubled economy was canceled. Euro -Zone leaders are ready to fight any defaults to avoid contagion to other bond markets such as Italy and Spain .On the technical side of the equation,the Eur/Usd formed a bearish pin bar on the daily off the 20 moving average and seems to be poised for more bearish momentum this coming week in continuation with the trend.

The Eur/Gbp also rallied massively on Friday loosing most of its gains. I will be watching for further bearish momentum on Monday with its bearish pattern formation from Friday for a touch of the trend line from August 2010 to date.

The Eur/Jpy has also formed a similar pattern with expectation that the pair may be moving lower this coming week to earlier lows. The Cad/Yen has formed a very bearish pattern with risk aversion setting in and a flight to safety for investors on Friday after the down grades by Fitch may send the pair much lower this coming week.The Loonie may have gained some ground with the NFP news of a positive increase of 103k jobs but was out weighed by the downgrades which we may continue to see this coming trading week.The pair went as far as 75 level off the 20 moving average but fell back to form a bearish candle that may signal a bearish

continuation.

The Usd/Cad has also formed a bullish pin bar from an area of support and the 21 day moving average which signals a bullish move on the pair from Friday's positive NFP release.

Gbp/Cad and Gbp/Nzd formed a bullish pattern that may be a continuation of the longer term trend from the minor correction.The Gbp/Cad bounced off the 50% fib area and the two 20 and 50 day moving averages to close above the 6150 area signaling further bullish momentum. A target of 6378 highs area should be expected if all technicals remain constant.

Gbp/Nzd has also bounced off the 38.2% fib level and the 20 day moving average and is headed for the 2.05830 area which are the highs on the 10th of April this year.

The Antipodes have formed a major bullish pin bar on the weekly charts which may signal a bullish correction this coming week.However on the daily's they tell a whole different story with the fundamentals supporting a bearish momentum on these currency pairs.The Aussie has a major pin bar off the 50% fib on the weekly chart and a bullish divergence on the RSI.However the daily has a bearish twist to it with a minor pin bar off the 21 day moving average and a bearish momentum from early September.

The Nzd/Usd and the Nzd/Jpy which seem to be positively correlated have also formed a bullish correction candle on the weeklies with RSI showing bullish divergence especially with the Nzd/Usd coming off near the 61.8% fib and from the lows on the 23rd of May to the highs on the 31st of July this year.

Wish you the best trading this week and make sure you do your own analysis.

The Eur/Gbp also rallied massively on Friday loosing most of its gains. I will be watching for further bearish momentum on Monday with its bearish pattern formation from Friday for a touch of the trend line from August 2010 to date.

The Eur/Jpy has also formed a similar pattern with expectation that the pair may be moving lower this coming week to earlier lows. The Cad/Yen has formed a very bearish pattern with risk aversion setting in and a flight to safety for investors on Friday after the down grades by Fitch may send the pair much lower this coming week.The Loonie may have gained some ground with the NFP news of a positive increase of 103k jobs but was out weighed by the downgrades which we may continue to see this coming trading week.The pair went as far as 75 level off the 20 moving average but fell back to form a bearish candle that may signal a bearish

continuation.

The Usd/Cad has also formed a bullish pin bar from an area of support and the 21 day moving average which signals a bullish move on the pair from Friday's positive NFP release.

Gbp/Cad and Gbp/Nzd formed a bullish pattern that may be a continuation of the longer term trend from the minor correction.The Gbp/Cad bounced off the 50% fib area and the two 20 and 50 day moving averages to close above the 6150 area signaling further bullish momentum. A target of 6378 highs area should be expected if all technicals remain constant.

Gbp/Nzd has also bounced off the 38.2% fib level and the 20 day moving average and is headed for the 2.05830 area which are the highs on the 10th of April this year.

The Antipodes have formed a major bullish pin bar on the weekly charts which may signal a bullish correction this coming week.However on the daily's they tell a whole different story with the fundamentals supporting a bearish momentum on these currency pairs.The Aussie has a major pin bar off the 50% fib on the weekly chart and a bullish divergence on the RSI.However the daily has a bearish twist to it with a minor pin bar off the 21 day moving average and a bearish momentum from early September.

The Nzd/Usd and the Nzd/Jpy which seem to be positively correlated have also formed a bullish correction candle on the weeklies with RSI showing bullish divergence especially with the Nzd/Usd coming off near the 61.8% fib and from the lows on the 23rd of May to the highs on the 31st of July this year.

Wish you the best trading this week and make sure you do your own analysis.

Monday, October 3, 2011

Weekly trades

This is a week packed with a lot of fundamental news releases from the RBA,MPC,NFP,ECB and many more so you must really watch the markets for a game changer this week. Rhetoric from any of the officials of these countries may cause a lot of volatility especially if they come in against market expectation.However,in most cases technical analysis has already factored in what is expected and its usually a case of sell the rumor and buy the fact.I will be watching the Eur/Usd pair especially with the weekly signaling a bearish momentum considering the many unending problems with temporary fixes. A break of the major trend line and the 50% fib indicates some more downward momentum towards the 61.8% fib.

The Aud/Nzd seems to be forming a head and shoulder pattern on the daily chart that I believe may totally play out depending on the outcome of the RBA decision meeting this week. Fundamentally,the two currencies have been bearish against the US dollar with Newzealand being down rated by S&P to a lower status while the Australian dollar interest rates expectations being dovish for the considerable future.However,we will watch the pair closely and see if we can make the pips should the pattern play out as expected.

Good luck trading and make sure you do a thorough analysis considering the fundamental news releases this whole week.

The Aud/Nzd seems to be forming a head and shoulder pattern on the daily chart that I believe may totally play out depending on the outcome of the RBA decision meeting this week. Fundamentally,the two currencies have been bearish against the US dollar with Newzealand being down rated by S&P to a lower status while the Australian dollar interest rates expectations being dovish for the considerable future.However,we will watch the pair closely and see if we can make the pips should the pattern play out as expected.

Good luck trading and make sure you do a thorough analysis considering the fundamental news releases this whole week.

Subscribe to:

Posts (Atom)